Mastering the Market: A Comprehensive Guide to Trading Bot for Pocket Option

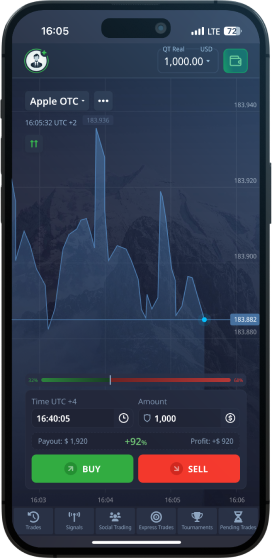

In the world of online trading, efficiency and speed can significantly impact profit margins. One tool that traders are increasingly utilizing is a trading bot for pocket option trading bot for pocket option. This automated trading system has the potential to enhance trading strategies, minimize emotional decision-making, and ultimately improve profitability. In this article, we will delve into how trading bots work, their advantages, and how to choose one effectively.

What is a Trading Bot?

A trading bot is a software application that automatically buys and sells assets based on predetermined criteria. These bots are programmed to analyze market trends, execute trades, and manage portfolios without the need for human intervention. They leverage algorithms to follow trading strategies, which can adapt to current market conditions in real-time. Given their efficiency, trading bots have become an essential tool for many traders, especially in a volatile environment like the Pocket Option platform.

Why Use a Trading Bot for Pocket Option?

The Pocket Option platform allows traders to trade a wide variety of assets, including forex, cryptocurrencies, and commodities. The dynamic nature of these markets can be overwhelming, making it challenging for traders to make informed decisions consistently. Here are several reasons why using a trading bot for Pocket Option can be advantageous:

1. 24/7 Trading Capability

Unlike human traders, trading bots can operate continuously without interruption. This means that even while you sleep, your trading bot can monitor the market and execute trades based on your chosen parameters, ensuring that you do not miss lucrative opportunities.

2. Elimination of Emotional Trading

Emotional decision-making can lead to poor trading choices. A trading bot operates solely based on data and algorithms, removing the possibility of stress or fear influencing trades. This objective approach can lead to more consistent results over time.

3. Speed and Accuracy

Trading bots can analyze data and execute trades faster than any human could. This speed is crucial in a fast-paced market where prices can change in an instant. Bots can also implement complex strategies that are difficult for human traders to execute manually.

4. Backtesting Capabilities

Many trading bots offer backtesting features, allowing traders to test their strategies using historical data. This functionality enables traders to refine their approach before applying it to live trading, which can significantly enhance performance.

How to Choose a Trading Bot for Pocket Option?

When selecting a trading bot for Pocket Option, consider the following factors to ensure that you choose the best option for your trading needs:

1. Strategy Compatibility

Ensure that the trading bot supports the strategies you wish to implement. Whether you prefer trend following, scalping, or other methods, the bot should align with your approach to trading.

2. User-Friendly Interface

A user-friendly interface is essential, especially for those new to trading bots. A complicated setup could lead to costly mistakes. Look for bots that offer a straightforward installation and setup process.

3. Performance and Reliability

Investigate the performance history of the trading bot. Check user reviews and feedback to gauge reliability and effectiveness. A bot with a proven track record will inspire more confidence as you trade.

4. Cost and Budget

Consider the costs associated with the trading bot. While some bots are free, others may require a subscription or percentage of profits. Ensure that the expenses align with your trading budget and anticipated profitability.

Common Strategies Utilized by Trading Bots

Trading bots can employ a variety of strategies, each designed to capitalize on different market conditions. Here are a few common strategies that you might consider:

1. Arbitrage

Arbitrage strategies take advantage of price discrepancies between different markets. By simultaneously buying and selling an asset across various exchanges, traders can profit from these differences.

2. Momentum Trading

Momentum trading focuses on trending assets, with the goal of buying during upward trends and selling during downward trends. This strategy relies on the bot to identify significant price movements.

3. Mean Reversion

This strategy assumes that the price of an asset will revert to its average over time. Trading bots can execute trades when prices deviate significantly from their historical averages, betting on a return to the mean.

4. Technical Analysis

A trading bot can utilize technical indicators—like moving averages, RSI, and Bollinger Bands—to inform its trading decisions. By analyzing market data and patterns, these bots can execute trades that align with technical signals.

Conclusion

In the ever-evolving landscape of online trading, utilizing a trading bot for Pocket Option can provide significant advantages in speed, efficiency, and accuracy. By automating trading activities and employing sophisticated strategies, traders can optimize their performance and minimize emotional biases. As with any trading tool, it is essential to do thorough research and choose a bot that best fits your trading objectives. With the right approach, a trading bot can be a powerful ally in your quest for trading success.